mortgage refinance transfer taxes

Florida Mortgage Refinance Transfer Taxes - If you are looking for lower monthly payments then we can provide you with a plan that. How to Pay Closing Costs When Refinancing Your Mortgage.

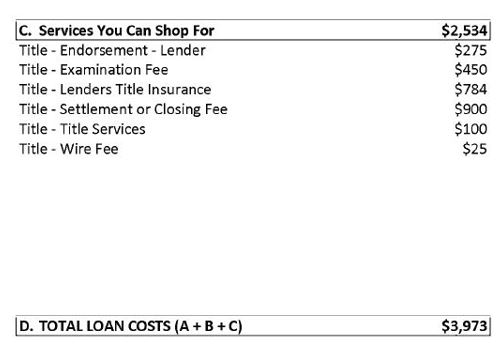

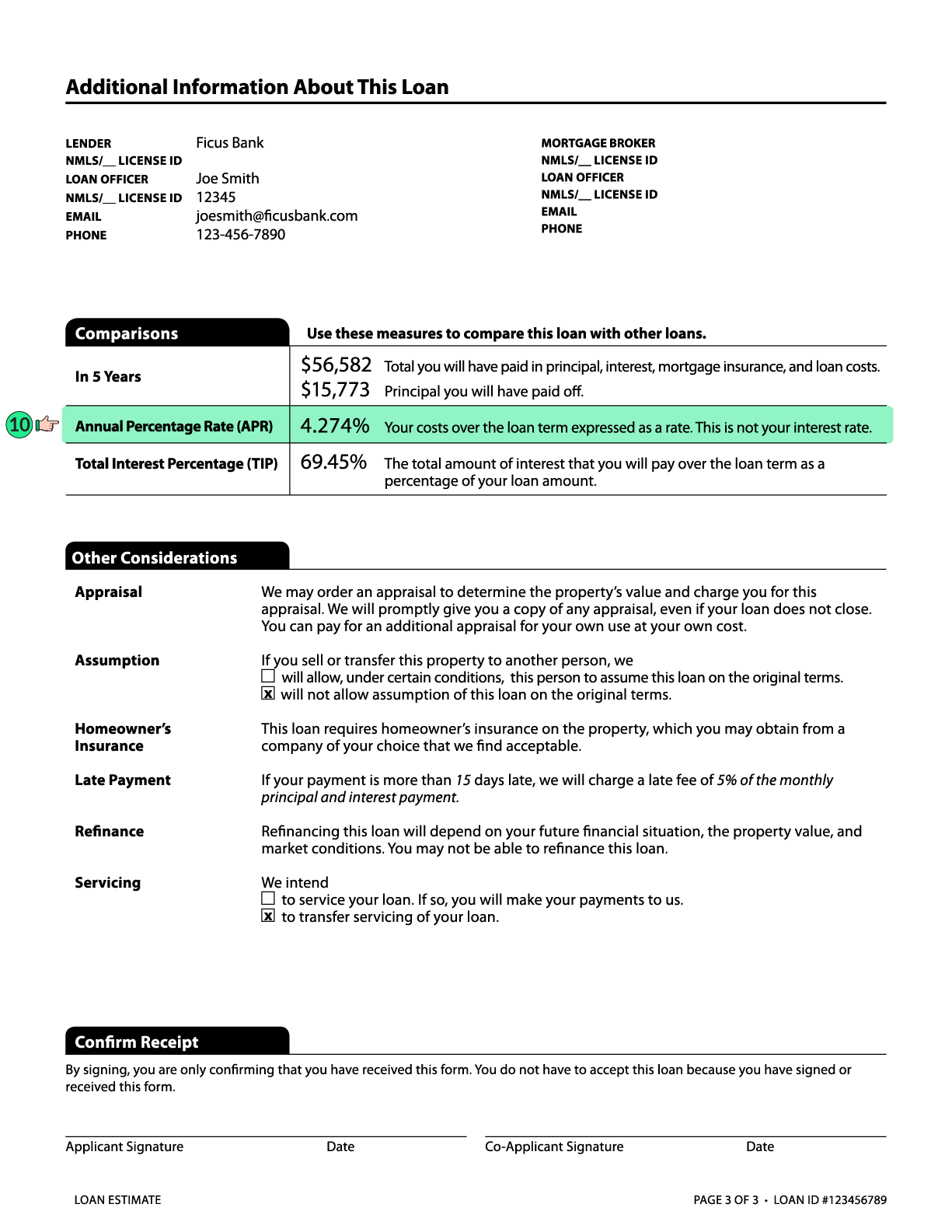

What Is A Loan Estimate How To Read And What To Look For

The only government fee you will pay on refinancing a home in Delaware is the recording fee to the county for recording the new mortgage.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

. Purchasing A Home In Florida Florida Refinance. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of. Mortgage Refinance Calculator With Taxes - If you are looking for a way to reduce your expenses then our trusted service is just right for you.

70 cents per 100 Documentary Stamps State Tax on the Deed. According to Section 201021a Florida Statutes Deeds and other documents that transfer an interest in Florida real property are subject to documentary stamp tax. Should there be a mortgage on the property the buyer will pay a recordation tax to the State of Virginia.

The average transfer tax is 1 to 3 per 1000 of the sales price but some areas add additional transfer taxes on top of the base costs. Florida Mortgage Refinance Transfer Taxes Oct 2022. Quicken Loans was once again named to FORTUNE.

The seller pays a transfer tax to the state also known as the VA Grantor tax. Some more popular cities tend to charge additional. Delaware doesnt have a mortgage tax either.

Mortgage Refinance Calculator With Taxes Nov. A property selling for. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000.

You can add the amount you paid for transfer or stamp taxes to the original purchase price of your home to increase your cost basis. A transfer tax is a real estate tax usually paid at closing to facilitate the transfer of the property deed from the seller to the buyer. On any amount above 400000 you would have to pay the full 2.

State Transfer Tax is 05 of transaction amount for all counties. Mortgage Calculator Maryland - If you are looking for options for lower your payments then we can provide you with solutions. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

Here is how the CEMA tax is calculated and how much you can save when you pay taxes on a condo with a sale price of 750000 a buyer loan size of 600000 an outstanding. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the. Transfer taxes are not tax.

Like many things there is one exception to this rule. Some states require that you re-register your vehicle. New York 2000.

If the property is a work. Mortgage Calculator Maryland Nov 2022. No transfer taxes are not tax deductible since they are a charge to legally transfer a real estate title.

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. Depending on where you live you may have to pay transfer.

What Are Deed Transfer Taxes Smartasset

Should I Transfer The Title On My Rental Property To An Llc

Transfer Tax In A Refinance Transaction Property Legal Counsel

Should I Transfer The Title On My Rental Property To An Llc

Reducing Refinancing Expenses The New York Times

Refinancing Your House How A Cema Mortgage Can Help

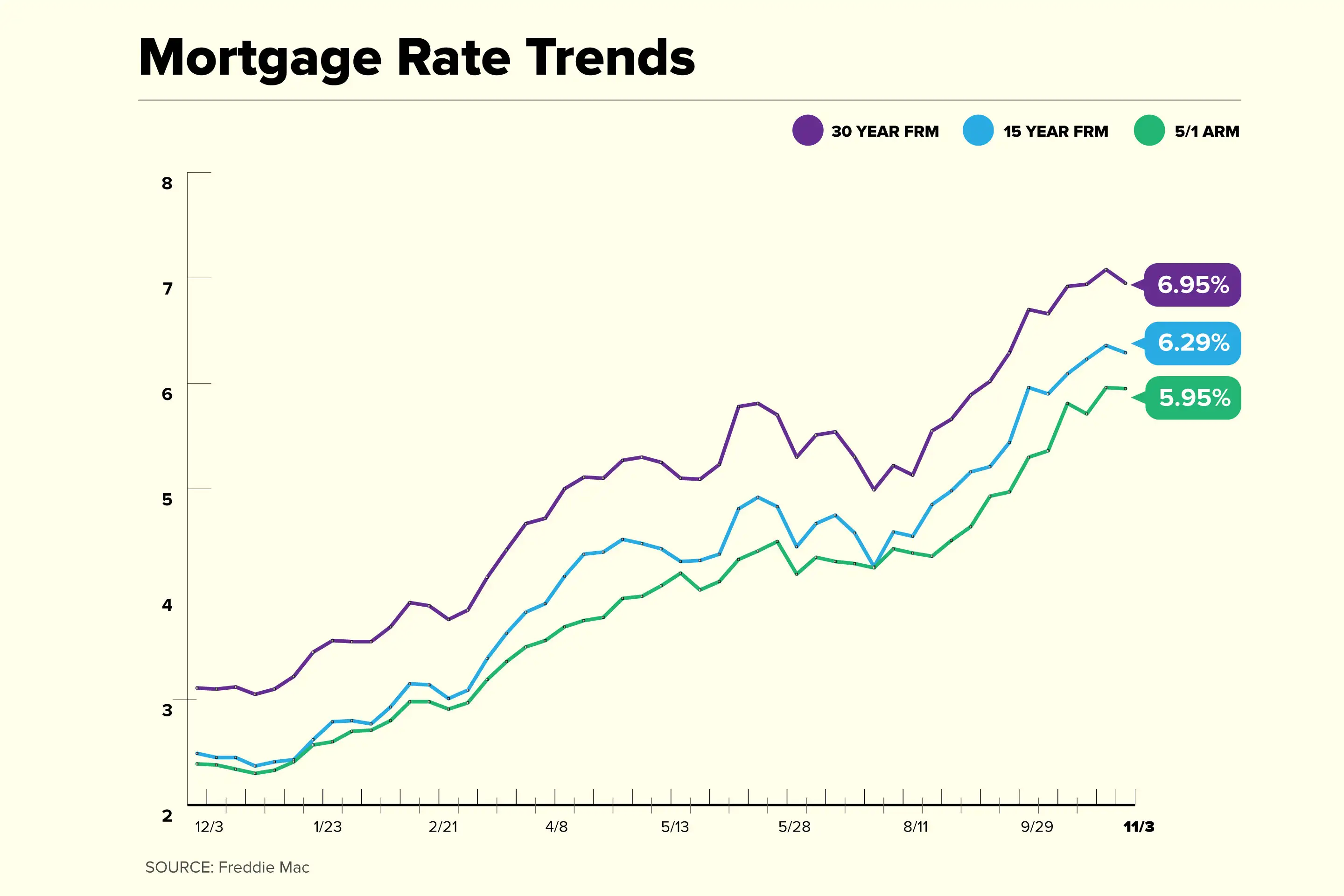

Should You Pay Mortgage Discount Points For A Lower Rate

Mortgage Refinance Rates Discover Home Loans

Best Mortgage Refinance Lenders Of November 2022 Nerdwallet

Understanding Closing Costs Sirva Mortgage

What Is A Loan Estimate How To Read And What To Look For

5 Things You Need To Know About Transfer Taxes First Savings Mortgage

:max_bytes(150000):strip_icc()/can-you-transfer-a-mortgage-315698-5b881051427b4839a5bd362f7f973b16.jpg)

How To Transfer A Mortgage To Another Borrower

Homebuyer Tax Credit Mcc Idaho Housing And Finance Association

What To Know About Refinancing A Mortgage In 2022 Money

What Are Closing Costs And How Much Will I Pay